Gas market overview Q1 2023

Return to competitive levels

- Prices continue to fall sharply in Q1

- LNG imports remain high, more terminals launch in Europe

- Storage levels historically high thanks to mild weather and continuous LNG flows

- Demand side to determine where the prices go next

Prices continue to fall sharply in Q1

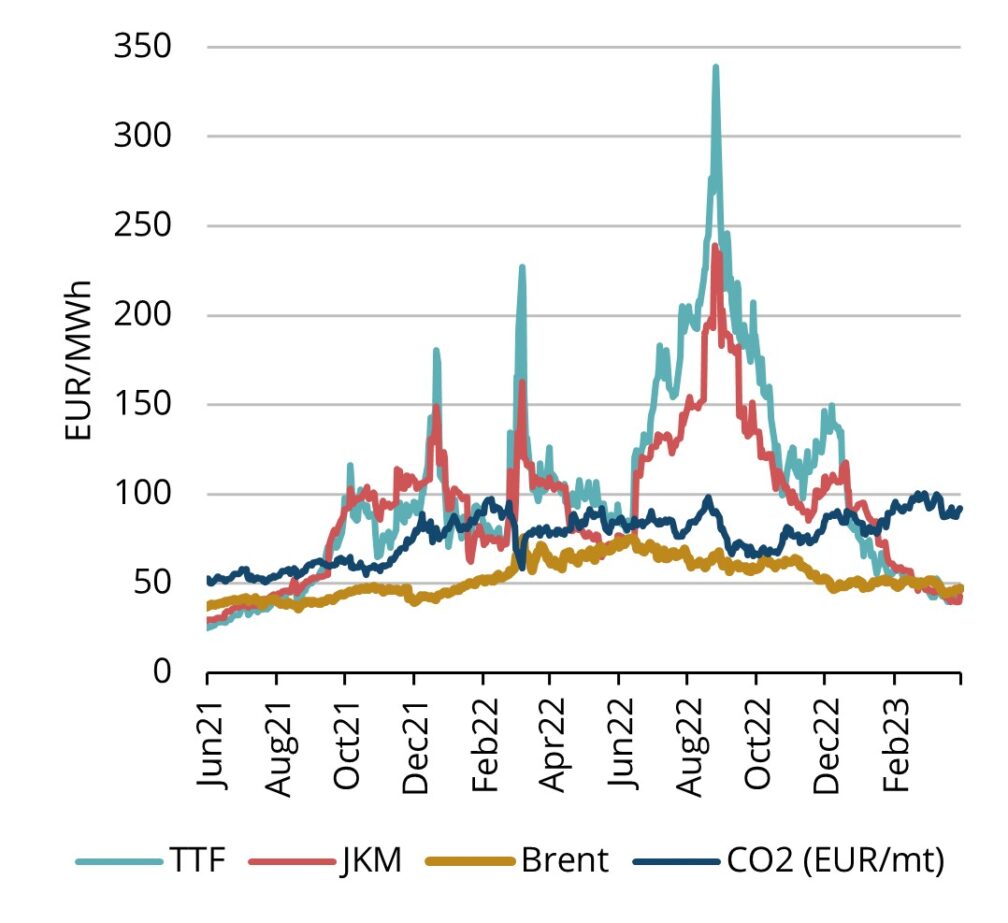

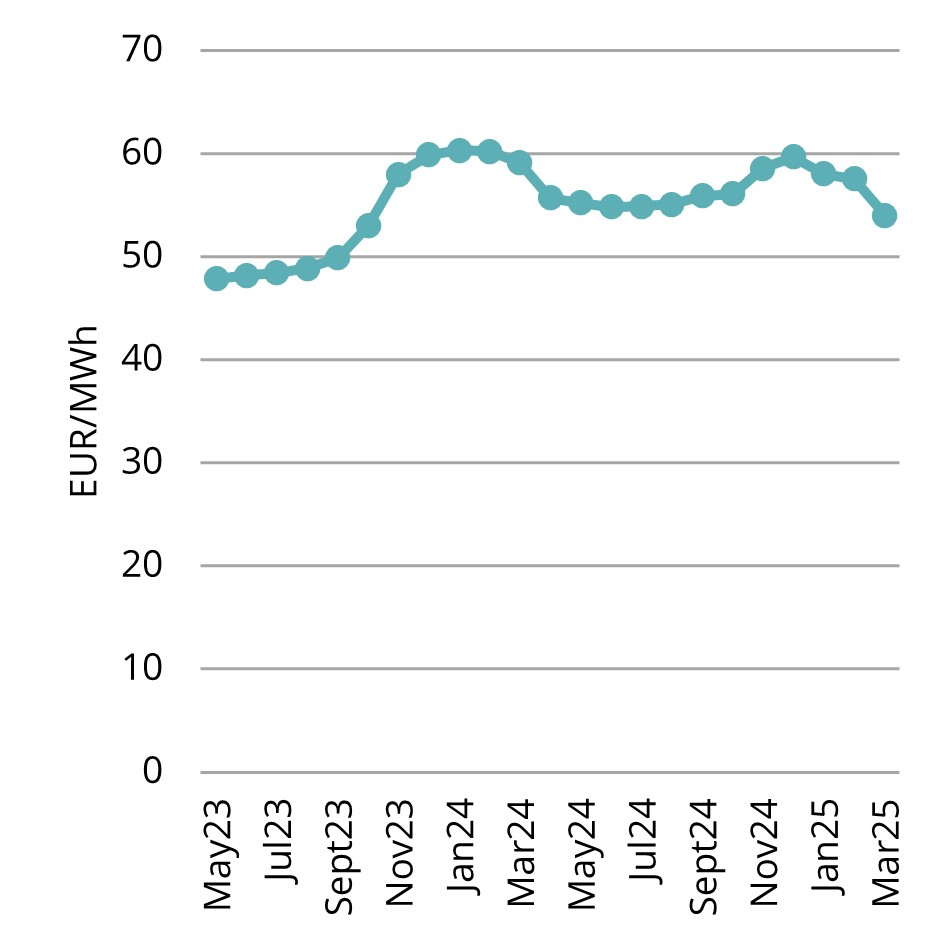

In Q1 2023, the average European natural gas benchmark TTF price was 79.16 EUR/MWh, prices finally showing a roughly 16% decline over the same quarter the year before. April 2023 TTF price has settled at 43.974 EUR/MWh, lowest since the summer of 2021 (see fig. 1). The TTF forward price for the nearest month May 2023 traded at around 47.84 EUR/MWh on the last day of Q1. On the forward curve, prices are in relatively sharp contango, meaning each future month is priced slightly higher than the preceding month, all the way up to January 2024 where the forward price levels are at around 60 EUR/MWh (see fig. 2).

During Q1, natural gas prices continued to decline due to record LNG imports on the supply side and mild weather combined with energy savings on the demand side.

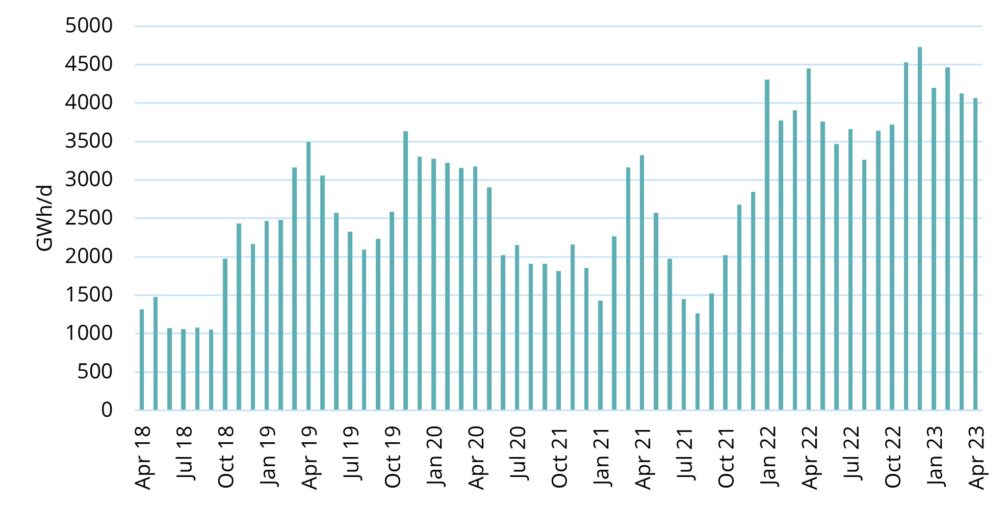

Figure 3. LNG import to key European terminals (UK, NL, Germany, Belgium, France, Italy, Iberia), Refinitiv

LNG imports remain high, more terminals launch in Europe

LNG imports into Europe continued at a high pace in Q1 while Asian demand did not recover as much as many market participants expected. During March there were significant strikes against government’s pension reform in France’s LNG Dunkirk terminal which reduced the country’s LNG import. However, others in the region were able to compensate for it as Germany added two more LNG terminals in addition to its first LNG terminal in Wilhelmshaven which they launched in December. Netherlands as Europe’s key gas hub was another state which boosted its LNG sendout in Q1 via its new Eemshaven terminal which launched last autumn. In our region, the Finnish Inkoo terminal was making final preparations for its first commercial cargo, imported by Elenger on the first days of April.

Storage levels historically high thanks to mild weather and continuous LNG flows

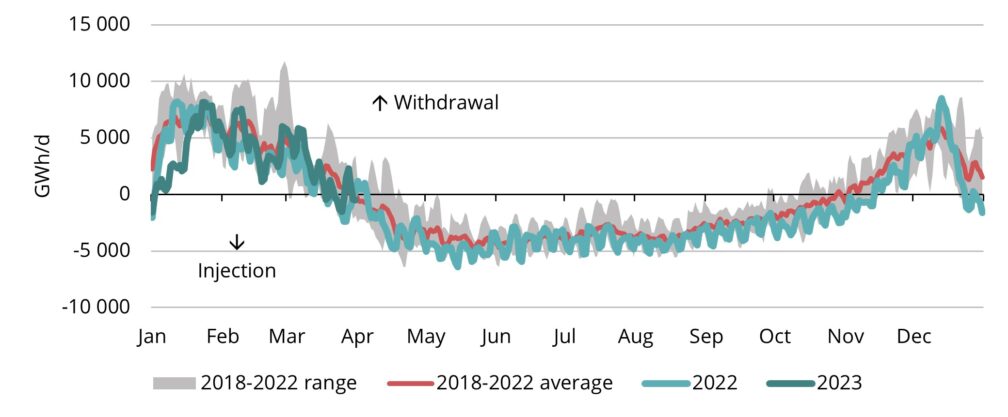

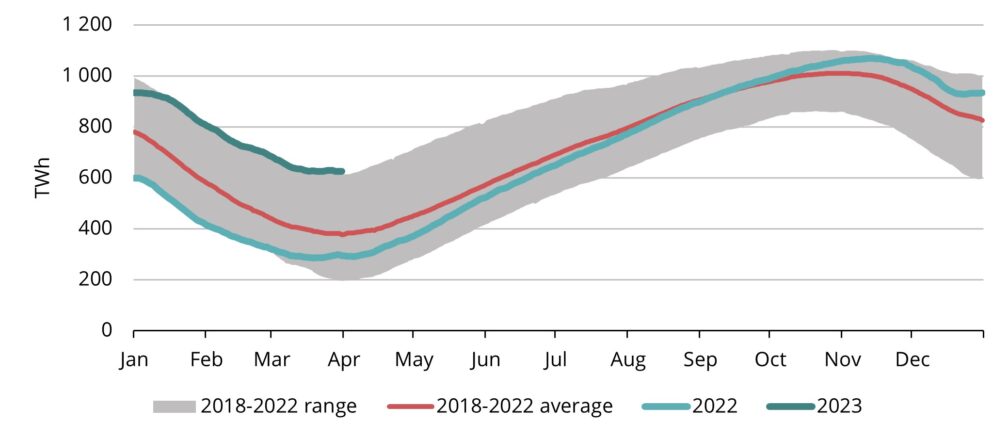

Despite of the Russian pipeline supply being gone, Europe has managed to exit the winter season at storage levels which are far higher than last five year’s average (see fig. 5). In addition to previously mentioned essential LNG flows, this result wouldn’t have been achieved without key factors on the demand side. Europe managed to keep the demand much lower than previous year’s as instead of EU’s regulation of 15% reduction in demand the actual numbers showed more than 20% fall in gas consumption in the region. Moreover, Europe got a much needed element of luck as the winter season passed with relatively mild temperatures.

Usually, European storages move from withdrawal to injection mode in April but this year injections started already in the middle of March, before needing some withdrawals due to a cold spell in the last week of March (see fig. 4).

Gas storages in Northwest Europe are over 50% full which is more than twice the amount stored in 2022 at the same time of the year. This should mean that last year’s rush to fill the storages which resulted in a panicky market and historical price spikes will not repeat this summer. However, there are still risks to be aware of this summer, most notably Norway’s high maintenance schedule, uncertainty regarding strikes in France and potentially vulnerable renewable energy generation across region as it’s dependent on weather conditions.

Demand side to determine where the prices go next

LNG supply has been strong and storage levels are very healthy which means that moving forward the key driver of gas prices is not anymore so much on supply, but rather on the demand side. Especially Asia’s demand recovery will play a key role in the price dynamics in the year ahead. Markets have been expecting China’s economy to restart fast after quitting its zero-Covid policy but so far Chinese LNG imports have not yet risen a lot. If Chinese gas consumption would increase noticeably then it would have impact on the LNG availability to Europe and push prices upwards as Europe and Asia compete for the same LNG imports. Refinitiv expects Chinese LNG import to grow 7.5% this year compared to 2022. Moreover, gas prices have dropped to a level which supports switching back to natural gas from alternative sources like coal or propane. This has already been seen in the market and will most likely result in demand increase going forward. Total demand in NWE and UK is expected to grow 6% year-over-year in 2023 summer season and 12% in winter (Refinitiv). If demand indeed recovers, then prices may need to rise in the latter part of the year to keep consumption in check and not put too high a burden on storages in the winter. However, EU extended its 15% demand cut target to March 2024 which could also limit the potential increase in demand.

This market overview is for informational purposes only. We aim to compile the most relevant data from various sources in good faith but the analysis should not be treated as an advice or taken as the sole basis for any action.