Gas market overview Q2 2022

Russian supply drying out

- Prices rise into the end of Q2

- Russian flows heavily decline

- Storage levels around historical averages, 80% target achievable

- Bottlenecked countries most at risk

- Additional LNG terminal needed

Prices rise into the end of Q2

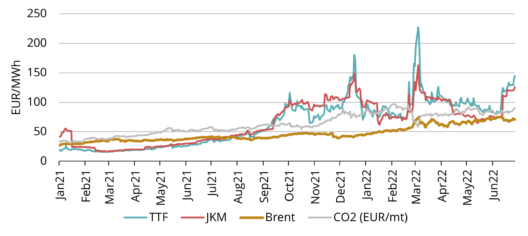

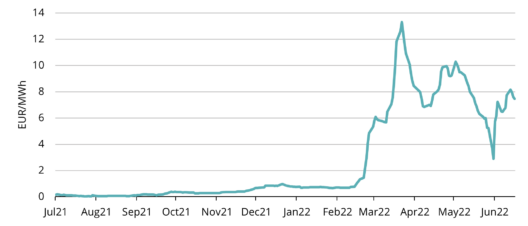

In Q2 2022, the average European natural gas benchmark TTF price was 107.60 EUR/MWh, a 5x increase over the same quarter the year before. The July 2022 TTF price has settled at 109.93 EUR/MWh and the TTF forward price for the nearest month August 2022 reached nearly 150 EUR/MWh on the last day of Q2. On the forward curve, winter 2022-23 is also at the end of Q2 priced at around 150 EUR/MWh with a drop to below 100 EUR/MWh only visible after April 2023.

Throughout Q2 prices gradually drifted downwards from 112 EUR/MWh at the start of the quarter to below 80 EUR/MWh before starting another surge higher in mid-June on renewed supply fears.

Russian flows heavily decline

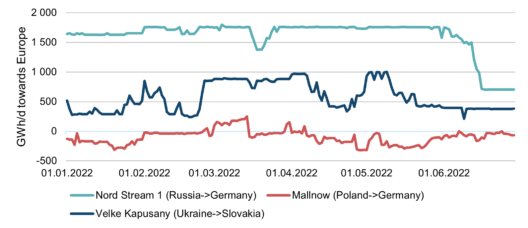

In the beginning of April, supply fears regarding Russia were fading a bit. Flows were ongoing as normal, and sentiment suggested that despite Russia demanding payment for gas in roubles it would still be possible to pay in contractual currency and just convert to roubles before the payment reaches Gazprom. This assumption was challenged in late April when Russia cut supplies to Poland and Bulgaria citing non-payment in roubles as the reason. Over the following weeks supplies were also cut to Finland, Denmark, the Netherlands, and some other specific buyers. Nevertheless, during most of the quarter, overall flows to Europe remained strong both on Russian as well as LNG side.

Another wave of fear and an accompanying rise in prices was brought along when Gazprom announced of technical issues on the compressor stations for Nord Stream 1. This reduced gas import through the main source of gas flows from Russia to Europe from a capacity of 1.7 TWh per day gradually over a few days to around just 0.7 TWh per day (light blue line on figure 2). This means that Russian imports to Europe are now at only about a third of maximum capacity.

Storage levels around historical averages, 80% target achievable

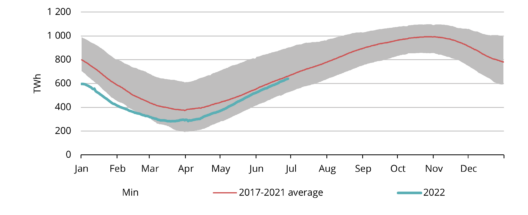

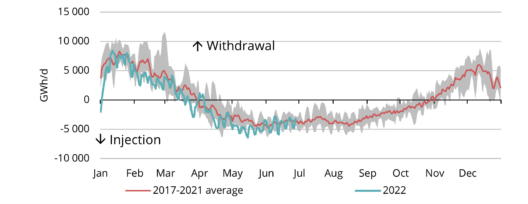

Despite starting the year at historically very low levels, European natural gas inventories built up strongly by mid-year. Total storage volume by the end of Q2 stood at 640 TWh (see figure 3), having caught up with the previous five-year average and amounting to 58% of full capacity. Injection pace in Q2 has been faster than usual. This has been possible due to record high inflow of LNG and due to Russian flows continuing largely as normal. However, as Russian flows have significantly dropped, the speed of injections has also dwindled. Injections normally peak in June but this year the peak appears to have been in May (see figure 4) with June numbers already lower, despite the cheaper gas price in June. The European Parliament has adopted mandatory storage levels of 80% by 1 November for all member states. At the current pace, this seems doable provided there are no further major supply disruptions.

Bottlenecked countries most at risk

With the Russian supplies most at risk, the countries that rely heavily on Russian imports without sufficient LNG import capacity, are in the worst situation. One of these countries is Germany that has a direct interconnection with Russia, where flows are now decreasing. Germany also has no LNG terminals to directly accept gas from other countries. So, they rely on stored gas and interconnections with neighbouring countries which might not be sufficient. This risk has led to a situation where although LNG is relatively plentiful in Europe for now, the German price area THE is priced around 8 EUR/MWh above the Dutch TTF benchmark (see figure 5). Historically the two areas have traded hand-in-hand but now there is risk of Russian supply cut which would create bottlenecks on the borders leaving Germany unable to import sufficient amounts of cheaper gas.

The Baltic-Finnish region is in a similar situation. We have one terminal in Klaipeda which can regasify 30-40 TWh of LNG per year whereas the demand from the four countries is around double that. Poland has been cut off from Russian gas so they are also importing Klaipeda gas via the new GIPL interconnection opened this May. Furthermore, there are capacity constraints between Lithuania and Latvia as well as between Estonia and Finland. Therefore, even if there is gas in the world, the infrastructure is not prepared to handle such a rapid shift in supply sources and that is likely to reflect in domestic prices, especially in those countries with infrastructure bottlenecks.

Additional LNG terminal needed

Works to establish a new LNG terminal in our region is well underway. Construction is ongoing in Paldiski to establish a moor and a connection to the transmission network and the Balticconnector pipeline. Finland is making similar preparations in Inkoo and has secured a 10-year lease for an FSRU (floating storage and regasification unit) which can be used as a floating LNG terminal. It is possible that the Finnish FSRU might be utilised in Paldiski in the upcoming winter if the Inkoo terminal is not completed in time but these plans are still open. Currently, the deadline for completion of required infrastructure works in Paldiski is 1 December 2022.

This market overview is for informational purposes only. We aim to compile the most relevant data from various sources in good faith but the analysis should not be treated as an advice or taken as the sole basis for any action