Gas market overview Q2 2024

Summer starts off with a rise in prices

- Prices turn upward in Q2 2024

- European storages over 75% full at end of Q2

- Rising LNG prices add to bullish sentiment

Prices turn upward in Q2 2024

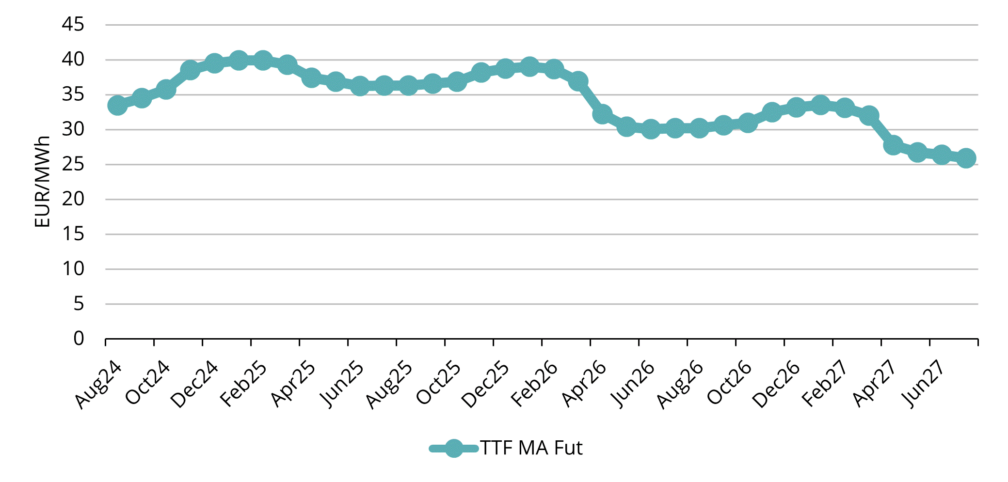

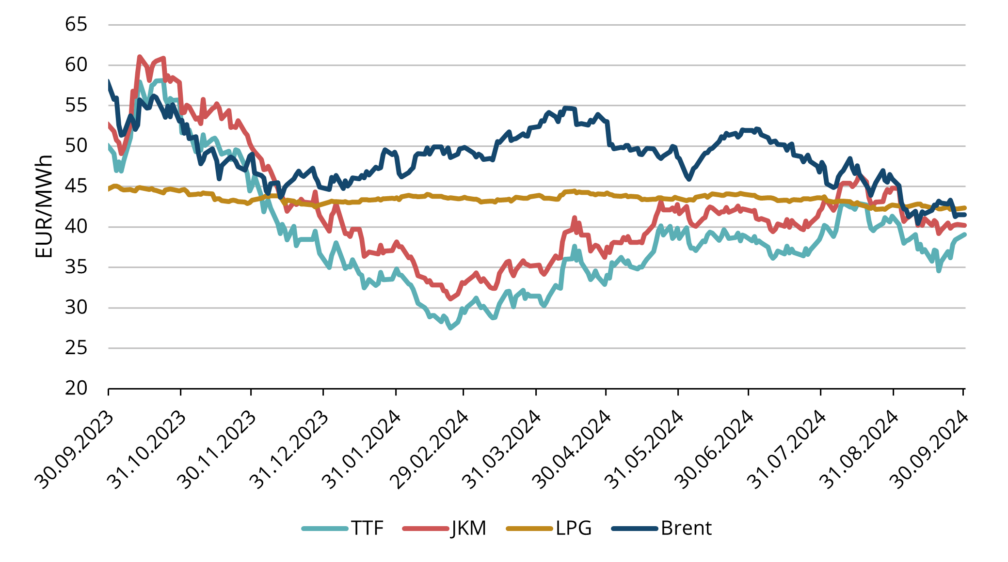

Gas prices experienced a strong downtrend from October 2023 until the end of Q1 2024. However, Q2 began with a rise. In April and May, prices trended upward, peaking on June 3rd at 38.56 EUR/MWh, the highest level for the TTF front-month price this year. Afterward, June saw prices mostly trade within a clear range (see Fig. 1).

The shift from a downtrend to an uptick was triggered by bearish headlines dominating the market in Q2. Three key themes emerged throughout the quarter:

- Geopolitical Tensions: Ukrainian energy sites, including gas storages, were attacked by Russia. Middle Eastern concerns continued, and the EU approved new sanctions on Russian LNG, prohibiting the reload of Russian LNG in the EU and banning investments in Russian LNG projects.

- Supply Worries: Norway, the main supplier of natural gas to Europe, experienced unexpected outages in their gas fields. Austria’s OMV indicated potential non-compliance with Gazprom’s payment rules, threatening a halt in their gas supply. In the US, a major LNG project engineer filed for bankruptcy, raising concerns over the timeline for additional LNG supplies.

- Heavy Maintenance Schedule: Summer is typically the season for maintenance in the energy sector, and Q2 saw extensive maintenance schedules in Norway, adding to market volatility. In our region, Klaipeda’s LNG terminal was in dry dock for a month and a half.

During Q2 2024, the average European natural gas benchmark, ICE Endex TTF front-month price, was 31.76 EUR/MWh. The ICE TTF forward price for the nearest full month, August 2024, closed at 33.48 EUR/MWh on June 28th.

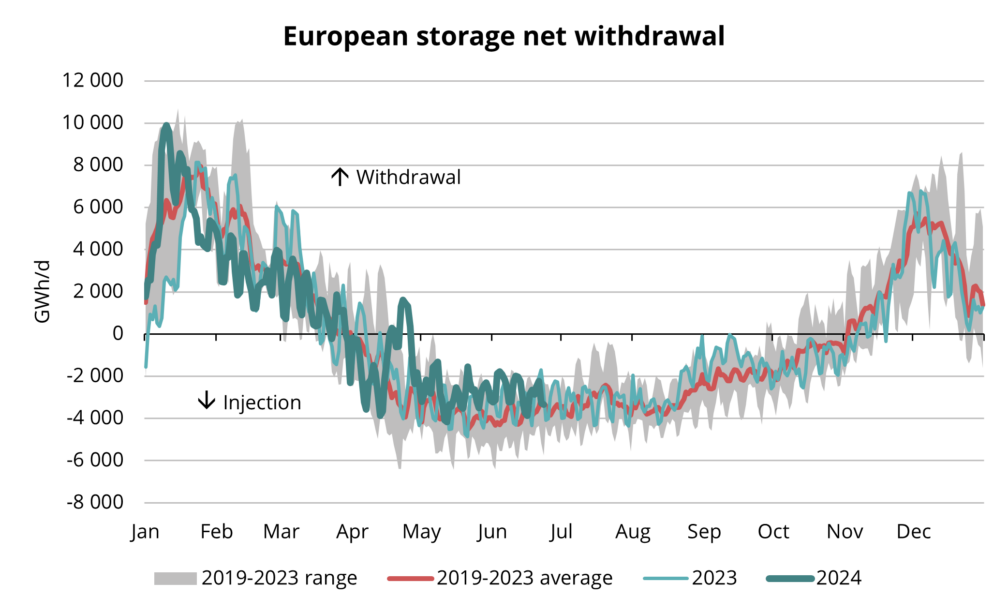

Looking at the forward curve, prices are in contango, meaning prices in coming months are higher than previous months on the curve until the end of the next winter period (see fig. 2). Coming winter is trading just below 40 EUR/MWh.

European storages over 75% full at end of Q2

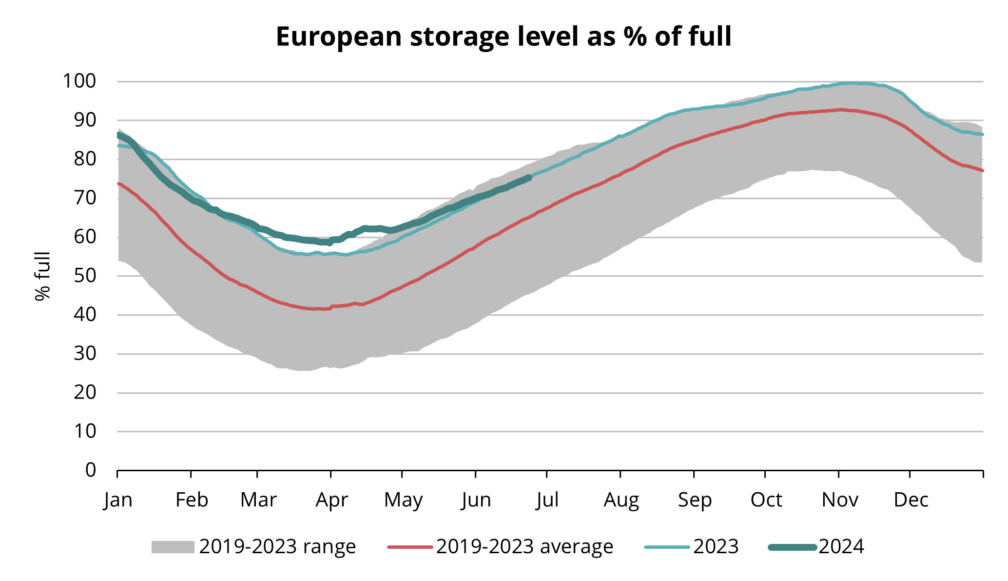

During the summer season, market participants primarily focus on filling storages and securing supply for the upcoming winter. European storages switched to injection mode at the beginning of April. However, a spike in demand coupled with simultaneous supply disruptions forced Europe to briefly return to withdrawal mode in the second half of April. From May onwards, injections have been healthy but below the 2019-2023 average injection speed (see Fig. 3). This slower injection pace has contributed to a bullish sentiment in the market, as lower injection speeds imply higher demand for injections later in the summer.

However, as Europe exited the winter period with historically high inventory levels, European storages remain much stronger than the 2019-2023 average, despite the slower-than-average injection speed. They are almost at the same level as last year (see Fig. 4). At the end of June, European gas storages are over 75% full.

Rising LNG prices add to bullish sentiment

In the first chapter, we mentioned key factors contributing to the price rise in Q2. While the heavy maintenance schedule will taper off during the summer, geopolitical tensions and supply worries are likely to dominate headlines in the coming months.

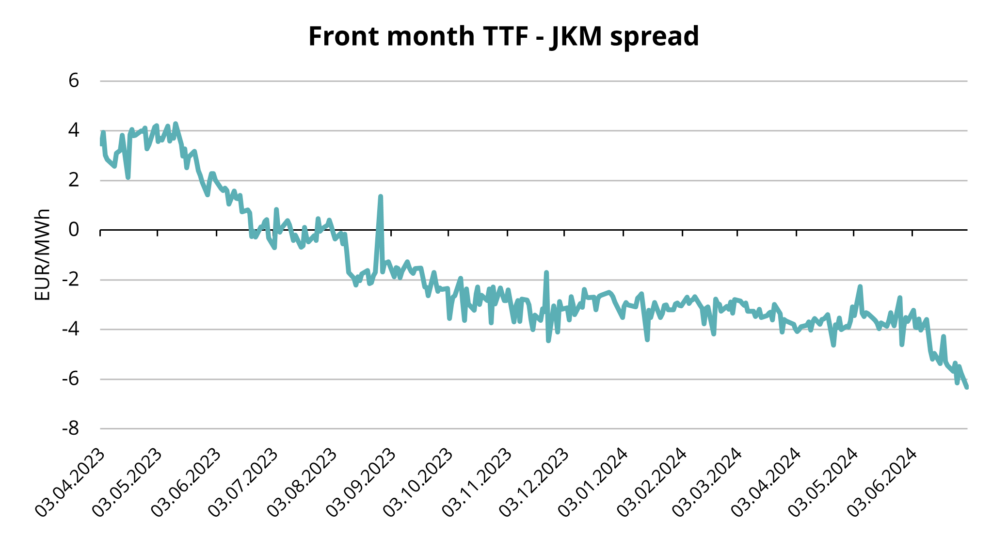

In previous analyses, we have highlighted the importance of understanding the global nature of the LNG market, particularly Europe’s dependence on demand from Asia. In recent months, Asia has seen increased demand due to two main factors: gas prices in Q1 dropped low enough to prompt a switch back to gas from other energy sources, and heatwaves in Q2 increased cooling demand.

This higher demand in Asia has driven up prices, with Asia’s key reference price index, JKM, rising faster than Europe’s TTF. Over the past few months, the spread between JKM and TTF has widened by roughly 4 EUR/MWh. As a result, Asia’s JKM is now over 6 EUR/MWh higher than Europe’s TTF (see Fig. 5). This price disparity makes it more profitable for LNG suppliers to sell their cargoes to Asia rather than Europe. Consequently, Europe must pay higher prices to attract the necessary LNG supplies to fill its storages, which further pushes up prices in the European market.

In conclusion, Q2 was dominated by bullish news and headlines, including supply worries, geopolitical tensions, and extensive maintenance schedules. Since June, the TTF front-month has traded within a range, indicating market’s indecisiveness. This uncertainty stems from a mix of factors. On one hand, there are clear supply concerns, such as rising LNG prices and bans on Russian LNG reloads. On the other hand, demand in Europe is relatively muted, with storages already over 75% full. This reduces the need for injections and, consequently, for LNG cargoes to Europe during the summer. However, Europe cannot rely solely on storages to manage the winter period. Additional gas will be needed, and this gas has become more expensive due to increased Asian demand. It will be interesting to see which factor—demand or supply—the market will deem more important, potentially breaking out of the current range in one direction or the other.

This market overview is for informational purposes only. We aim to compile the most relevant data from various sources in good faith but the analysis should not be treated as an advice or taken as the sole basis for any action.