Gas market overview Q4 2023

Prices decline despite geopolitical tensions

- Strong price spike in October followed by clear downtrend during rest of the Q4

- European storages remain at historically high levels due to mild weather in Q4

- Finnish and Baltics gas markets disrupted by Balticconnector incident

- Geopolitical tensions in Middle-East

- What to expect from 2024

Strong price spike in October followed by clear downtrend during rest of the Q4

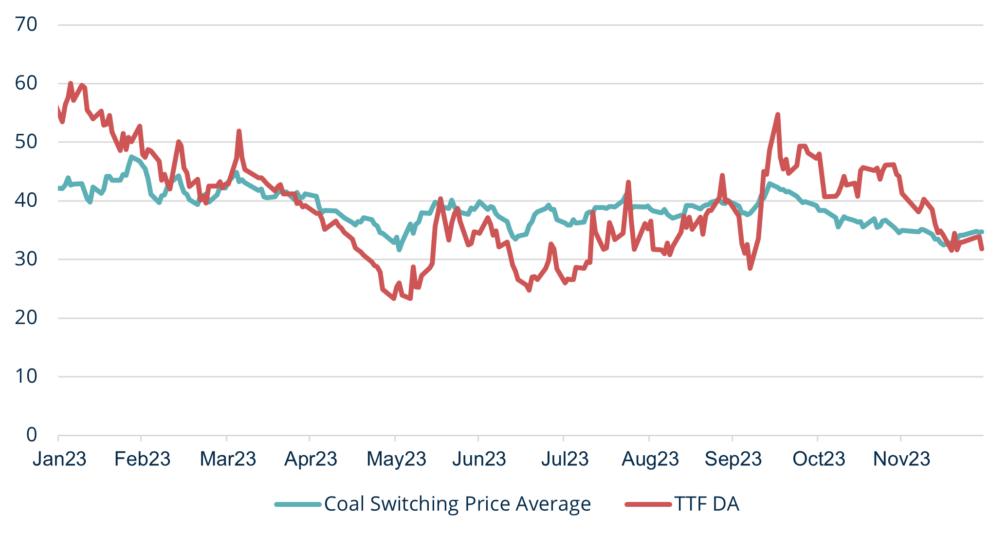

Q4 started off with quite a big jump in prices when looking at the front-month futures which are the main contracts for gas prices benchmarks. This surge was largely attributed to the shift into the winter months, a period which had already been priced higher throughout the year (you can refer to our previous publications for forward price graphs) as demand rises in winter months. Additionally, geopolitical unrest played a role as in our region Balticconnector was damaged and in Middle-East the Israel-Hamas war broke out. As a result, October saw increased volatility and higher prices. However, as November and December unfolded, the gas markets stabilized. The impact of geopolitical events waned, and mild weather in the NWE region, coupled with robust supply due to high storage levels, led to steadily declining prices.

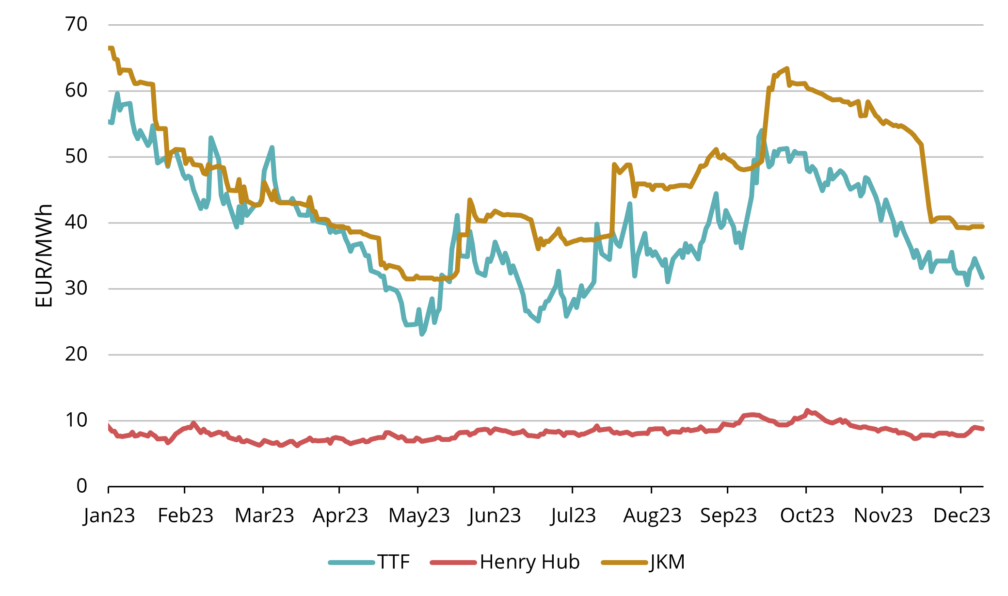

During Q4 2023 the average European natural gas benchmark, ICE Endex TTF, front-month price was 43.289 EUR/MWh. The ICE TTF forward price for the nearest full month, Feb 2024, closed at 32.35 EUR/MWh on the 29th of December.

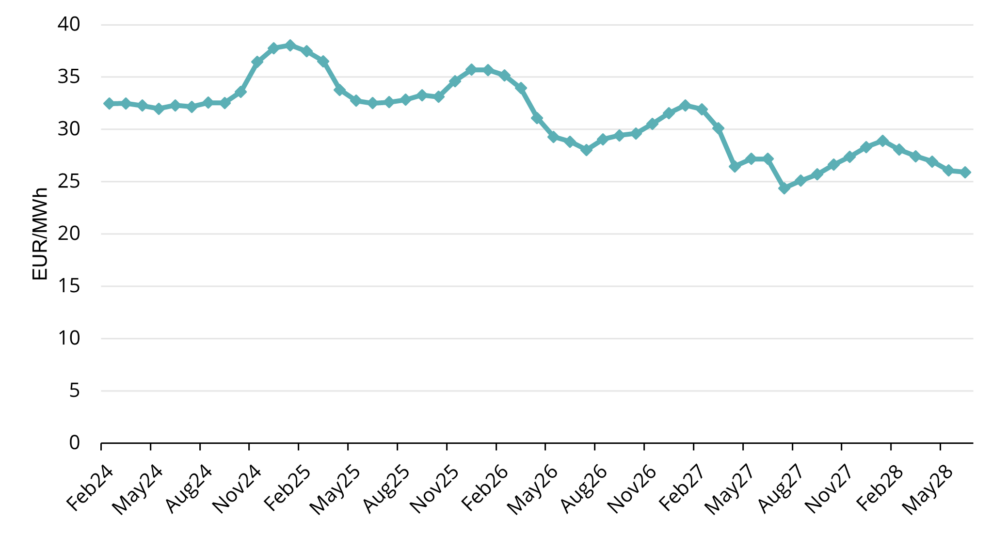

Looking at the forward curve, prices are relatively flat throughout the 2024 until the month of November. From there prices turn into contango, meaning prices in winter are higher than the first part of the curve (see fig. 2). There is roughly 5 EUR/MWh spread between the Feb24-Oct24 and Nov24-Mar25 period.

Taking a closer look at the nearer end of the curve—the next two years—reveals a trend that emerged around mid-October. The spread between 2025 and 2024 prices began to shrink noticeably during this period. This has resulted in a situation where 2025 is now being priced higher than 2024 (see fig. 3), indicating percieved reduced risk in near period with high storages and less demand.

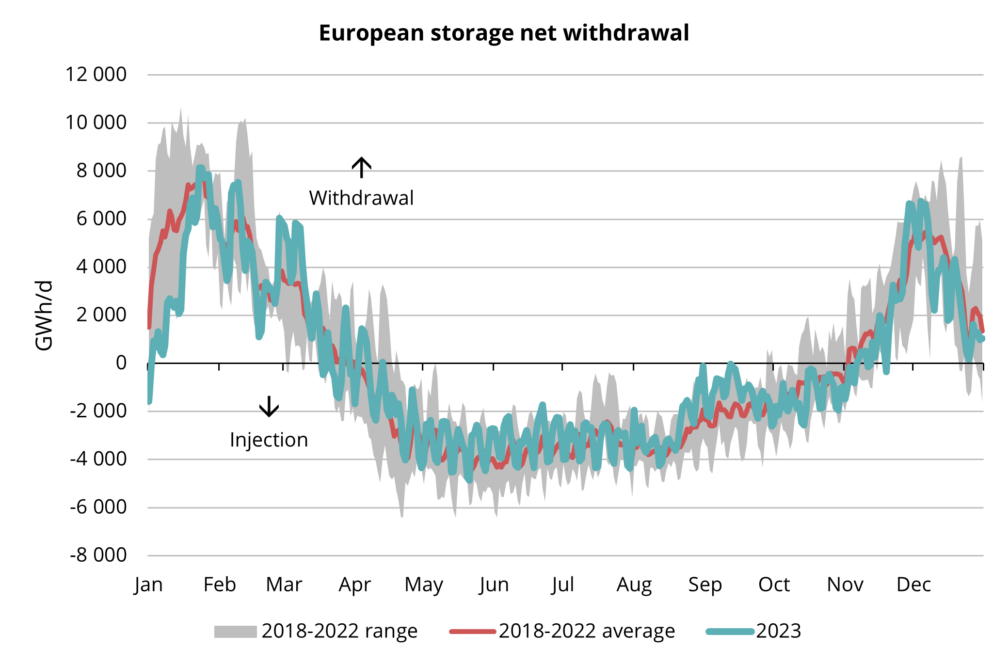

European storages remain at historically high levels due to mild weather in Q4

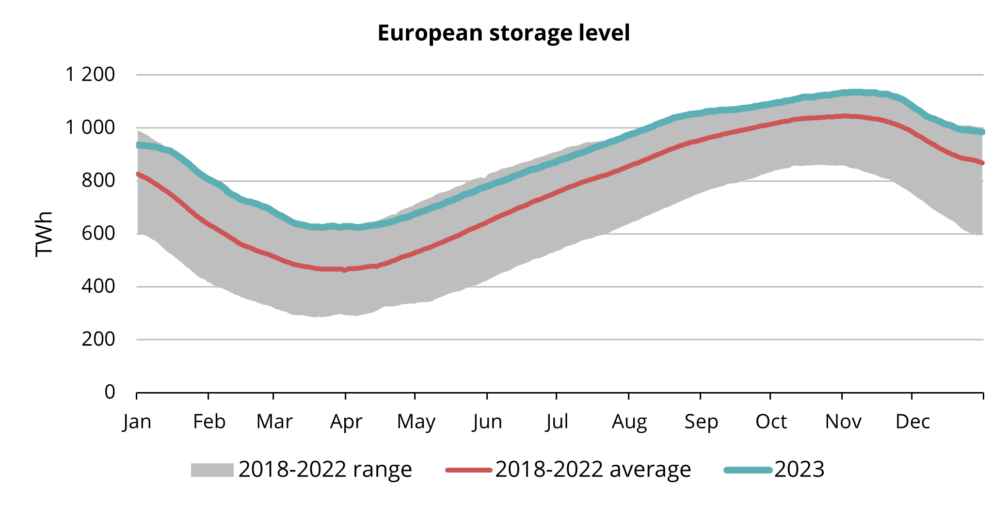

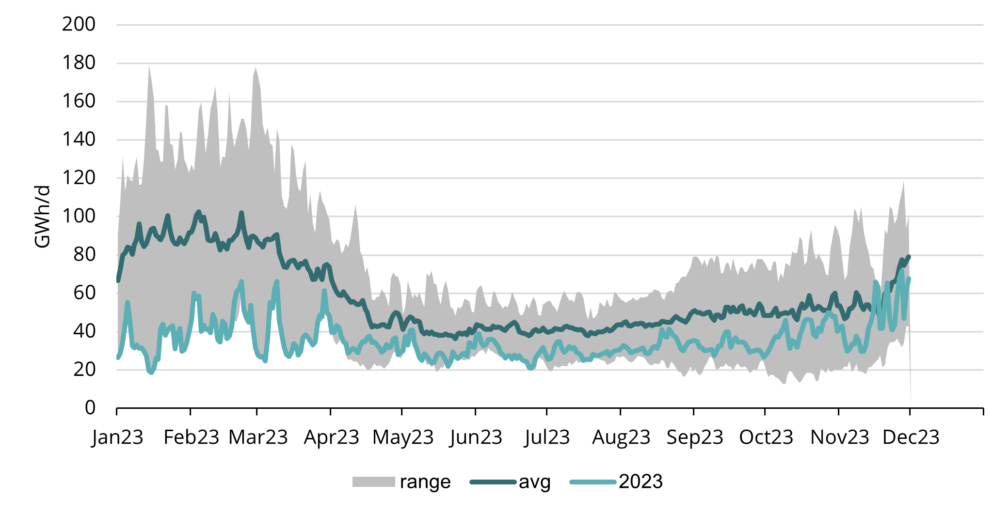

European gas storages have maintained historically high levels throughout Q4. As emphasized in our previous publications, these storages play a pivotal role in ensuring stability in gas supply across Europe, especially during the heightened demand of winter brought about by colder temperatures. Depending solely on LNG shipments wouldn’t sufficiently address the heightened requirements during this period of increased demand. Europe started the winter from historically high storage levels as summer saw very strong LNG inflows which enabled high injection levels. Since the first half of November, European storages have been in the net withdrawal mode. Europe turned into withdrawal mode a bit later then previous years (see fig.4) as the temperatures across NWE remained relatively mild during Q4 compared to seasonal averages and there was less heating demand. Another factor, apart from weather, has been Ukraine’s storages. Since mid-July, European traders started injecting into these storages at a rapid pace and Ukraine’s storages peaked at around 126 TWh in early November (Refinitiv). This figure is approximately 19% higher than in 2022. Since then, withdrawals have remained robust, and as of early January, Ukraine’s storages are roughly 5% higher than the previous year. This accelerated withdrawal from Ukraine’s storages indicates traders’ efforts to mitigate risks, enabling a slower depletion of NWE storages.

This resulted in European storages ending the year significantly higher than the average levels observed between 2018 and 2022 (see fig.5). High storage levels continued to be the key element for bearish fundamental view for gas prices which drived the prices lower throughout the Q4. Europe’s gas storage sites are over 85% full as end of the 2023 (Gas Infrastructure Europe).

Finnish and Baltics gas markets disrupted by Balticconnector incident

The standout event in our region during the quarter unfolded early in October when it was discovered that the Balticconnector, the gas pipeline linking Estonia and Finland, suffered extensive damage and required immediate shutdown. Gasgrid Finland OY, the Finnish gas transmission network company, later confirmed that the Balticconnector would remain offline at least until April.

This meant that Finland became kind of an isolated “energy island” removed from others as BC is the only gas pipeline connecting Finland with Baltics or Scandinavia. Consequently, Finland found itself reliant solely on its two LNG terminals, Inkoo and Hamina, with the latter being relatively smaller in capacity. Suppliers had to swiftly adapt their strategies because typically, during the winter, gas would flow from Latvia’s Inčukalns storage through Estonia to Finland. However, this route was no longer viable. Instead, the Finnish market has to depend entirely on new LNG shipments until the Balticconnector continues operations. This option, bringing in new LNG cargoes, incurs significantly higher costs. Winter gas prices are elevated compared to the rest of the price curve, and Finland’s geographical position brings added complexities, particularly the risk of strong ice formation during winter. Consequently, using ice-class vessels for LNG shipments becomes a necessity, but these vessels are less common ando also more expensive to employ.

On a positive side, Finland possesses LNG terminals, mainly relying on Inkoo, for its gas supply. Nevertheless, not having any pipeline connection makes the supply-demand balance extremely fragile and places pressure on all market participants, including system managers, suppliers, and consumers. Credit to all of them, so far Finnish market has been able to operate smoothly without any significant issues, even despite the very strong cold spike in the end of the 2023. It is also seen from consumption numbers as in the month of November the gas consumption in Finland was above the 2018-2022 average level for the first time since the Ukraine-Russia war (see fig. 6). It signals that Finland’s gas supply is secured through LNG terminals, indicating the market’s ability to function effectively through the remaining winter months. Nevertheless, it’s crucial for all market stakeholders to maintain collaboration and focus, given the minimal margin for error.

We ourselves managed to react fast to new market conditions and were allocated four out of seven slots for the winter period in Inkoo terminal. This enables us to secure the gas supply for our clients and Finnish region overall.

Geopolitical tensions in Middle-East

When our region was hit by the geopolitical turmoil due to Balticconnector incident, the world turned it’s eyes to Middle-East as Israel-Hamas war broke out in October. Due to the initial Tamar field shutdown in Israel for safety reasons, natural gas supply was hit in the region and through that global LNG balance was disrupted. From Tamar field gas is moved through pipelines to Jordan, who is LNG importer, and to Egypt, who is LNG exporter. This meant that Egypt could export less LNG and Jordan had to import higher LNG amounts from elsewhere, putting pressure on LNG prices globally. However, as Tamar field contributes to rather small portion, around 1.5%, of the global LNG supply (Goldman Sachs) and the complete shutdown did not last long then the price impact to global prices was rather limited after the initial shock which caused price spike and volatility in the first part of the October.

What to expect from 2024

As mentioned before, the persistently mild weather has curbed heating demand, maintaining relatively low levels. Coupled with robust inventory reserves and substantial LNG inflows into the region, TTF prices have been in the clear downtrend since the middle of October. Now we have reached the levels where there are more upside than downside risks for the TTF prices. There are two fundamental reasons for that as TTF trades below two key benchmarks which are closely monitored by the markets.

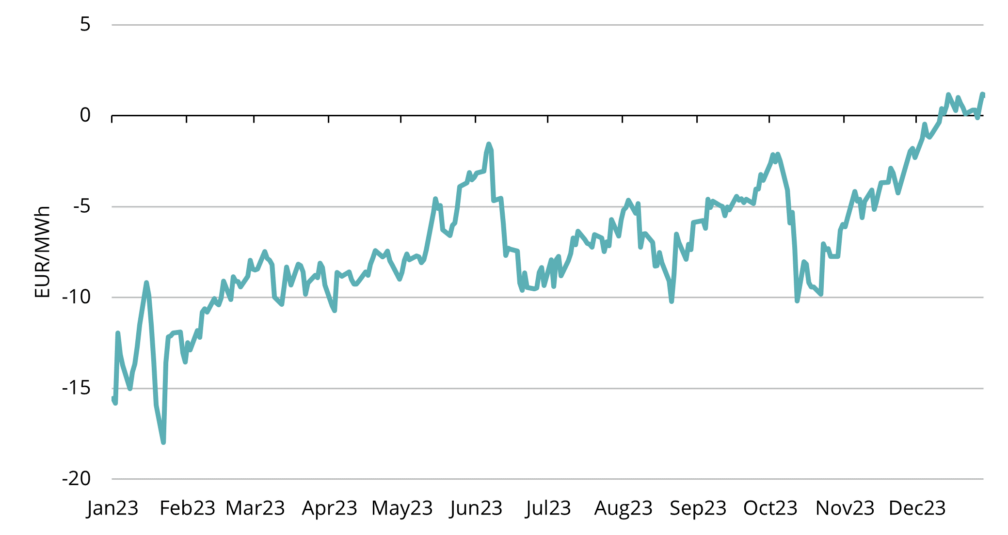

Firstly, gas prices have dipped below the coal-to-gas switching threshold (see fig. 7). It means that for power generation it is cheaper to use gas instead of coal (it takes into account coal prices and cos of emitting CO2 for gas and coal power generation). This should give support to gas prices as it boosts the demand from electricity producers.

Secondly, as we have discussed in our previous pieces, Europe competes with Asia for LNG as it is very much a global market. It means that traders sell their spot LNG cargoes (which are not linked with long-term contracts/deliveries) to the regions where prices are higher. Asia prices, reflected by JKM benchmark, are quite substantially higher than European TTF benchmark (see fig. 1). The primary driver of this trend has been the robust Asian demand. In December 2023, Asia imported 399 TWh of LNG, representing 68% of the global LNG market. This figure falls just slightly below the region’s all-time high, set in February 2021 when Asia imported 400 TWh of LNG (Goldman Sachs). European demand has been fairly low and storages have held up well, but should the demand pick up in Europe and storages start to decrease then it needs to be restored from LNG supplies. But going into the LNG market for spot cargoes would push the TTF prices higher to secure the supply Europe would need to compete with Asia where prices are higher. Near-term weather forecasts support a more bullish view, with predictions indicating significantly colder-than-average temperatures for NW Europe in January, likely bolstering demand.

Considering these key fundamental factors, it’s probable that there is more upside risk than downside risk in gas prices in the near term and the downward trend which we have seen during the last months could find its bottom. However, given the robust storage reserves and fully operational large LNG capacities in Europe, potential price uptick from current levels is anticipated to result in a relatively modest correction.

Looking ahead to 2024, we anticipate a more stabilized energy market compared to the past two years. Supply sources have adjusted to the new situation as there are numerous new LNG terminals in Europe. The bottleneck now shifts more toward LNG-producing nations, focusing on expanding LNG liquefaction capacities. Producing nations are actively working to bring more LNG to the global market. Major new projects in LNG liquefaction terminals are anticipated to enter the market from 2026. For this year it is still important to highlight that although the situation is stabilizing, the balance between gas demand and supply remains delicate in the market. Looking towards the upcoming season, a pivotal question revolves around the depletion of European gas storages by spring and injections ahead of the subsequent winter.

This market overview is for informational purposes only. We aim to compile the most relevant data from various sources in good faith but the analysis should not be treated as an advice or taken as the sole basis for any action.